What is the 256 Group What

Why 256 ? SHA-256 is a cryptographic algorithm created by the NSA, and is a core component of Bitcoins decentralised proposition. Our fundamental belief that blockchain and bitcoin are symbiotic entities has led us to focus on helping to build businesses which have both a viable business model and can be optimised by implementing core technology built around a blockchain….

256 Genesis - Blockchain Incubator

We focus on helping founders to create business which can provide a blockchain based solution to commoditising existing assets, such as real estate, mining, classic cars and many more….

256 Oracle - Digital Asset Hedge Fund

By using over 400 data points unique to digital asset sector, our filtering algorithm allows our investment team to consistently deliver returns in both bear and bull markets, with a focus on the emerging asset backed token class….

256 Node - DEX for asset backed tokens

We aim to provide any individual in the globe unique investment opportunities such as owning part of a Mayfair property, a futures contract on the output of a titanium mine in greenland, or an option on the future price of a classic Ferrari….

Why now ? OPPORTUNITY

The last 18 months has seen huge growth in both liquidity and interest in all things blockchain. However this has mostly been focused on trading poorly thought through ( and sometimes outright scam ) projects, which saw both huge returns and losses depending on when the cycle was entered. The next phase is beginning, and we aim to become a cornerstone of the industry, and provide the framework for true transformational industry shifts…

Technology

- With any technological advancement, the barrier to entry is developers to build new product – with so much funding entering the market there is now a pool to select from

- Blockchain solutions are focused on efficiency savings – likely huge demand when current global bull market recedes

Finance

- Current venture capital market is oversaturated with consumer services, leading to extensive overvaluation of start-ups, eg $1.7billion for an electric scooter company, so many funds are looking for new markets

- Stock market returns are rapidly slowing as the market enters the final cycle of a bull run, many investors are looking to enter alternative markets for 10%+ annual growth

Banking

- Fiat markets are increasingly volatile, and holding physical assets such as gold is both expensive and laborious

- Banks have not changed since the 2008 crash, and continue to offer limited services at high fees to global customers

Markets

- Investing in traditional markets is extremely difficult for those outside the jurisdictions in question e.g. NASDAQ and FTSE

- High growth markets have limited opportunities for retail investors to speculate within, and new instruments are over regulated

WHAT WE DO PROCESS

Our focus is on ensuring that any project we engage with reaches product-market fit, and so we have created a framework to mitigate against risks we’ve identified over the last 24 months…

We’re encouraging founders to move away from the current model of Whitepaper> Advisory Board > ICO. We focus on empowering them to build a Minimum Viable Product, before any token offering, and plan a multi stage launch to ensure all investors have liquidity options.

- We identify businesses or individuals with extensive operational networks, through 256Genesis, who can provide or create asset holdings to supplement their token offering. We then support these individuals through product build and initial launch.

- Post MVP build we then connect our founder partners with our extensive network of institutional funds, such as family offices, and offer pre token event investment opportunities.

- Post token event our retained tokens are then traded via 256Oracle, our algorithmically driven hedge fund, across 65 exchanges. Once global liquidity levels are reached, they are also listed on 256Node, our DEX for asset backed tokens.

- We continue to support our founder partners, and look to offer them a private equity exit option when desired.

THE 256 SOLUTION SOLUTION

We’re building a comprehensive blockchain based ecosystem to solve key issues in the current financial and commercial markets. Some of our early features will be :

Contextual Blockchains

We’ll be building blockchain solutions based on what specific industries need

Fiat Access

We’ll provide our DEX customers with withdrawal options for the FIAT currency of their choice

Decentralized Network

Our systems and teams are fully dispersed so we do not have singular failure points

Full Transparency

All of our investments and product roadmaps will be accesible via a public blockchain

Distributed Infrastructure

Ensuring all of our platforms are secure against any incursions

Asset Secured Lending

We’re working on solutions to provide our members with instand liquidity secured by their portfolios

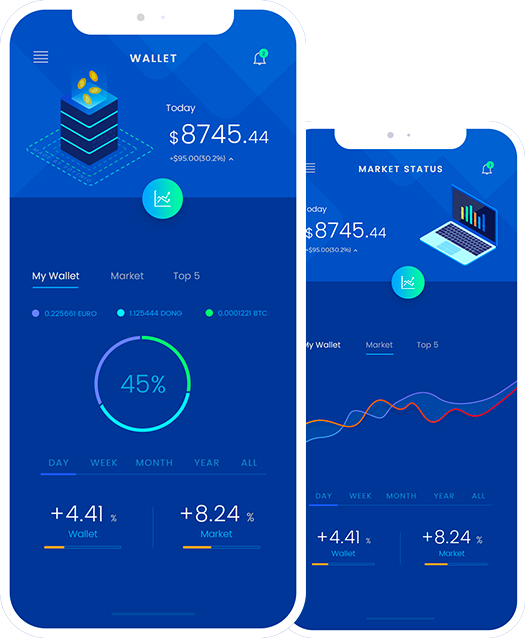

Next Generation Wallet

Holding identity, funds, services and your online personae, heavily encrypted and secure

Crypto Payment

We’ll provide DEX members with a debit card which will use their portfolio balance to fund transaactions

The 256 App Apps

Once you’ve entered into our ecosystem, you can manage every thing. Anyone with a smartphone and an internet connection can participate in the global digital asset marketplace.

We’re building an app for access to all 256 products. Our initial launch will include features such as :

- Crypto-news curation

- Live asset price

- Wallet aggregation

- Real time trading

OUR ROADMAP ROADMAP

September 2020

256Oracle Epsilon Fund opens

February 2021

Initial batch joins 256Genesis incubator

March 2021

256Oracle trading dashboard live

June 2021

256Node Testnet Live

July 2021

256Genesis Alpha batch launches MVPs and marketing sites

September 2021

256Node Live launch with 5 asset backed tokens

October 2021

256Oracle Epsilon Fund closes

Frequently asked questions FAQS

We’ve answered some frequently asked questions below. If you have any other questions, please get in touch using the contact form below.

256 Group Holdings is the legal entity which manages the assets and operations of a full cycle blockchain ecosystem, comprising of 256Genesis, 256Oracle, and 256Node...

We trade across all cryptocurrencies, based on our technical and fundamental analysis

Fill out the form below and one of our fund managers will be in touch

We constantly review business ideas and meet founders - please get in touch using the form below

256Genesis is a technology incubator that focuses on assisting founders in creating and launching asset backed blockchain powered companies

We trade across all cryptocurrencies, based on our technical and fundamental analysis

Fill out the form below and one of our fund managers will be in touch

We constantly review business ideas and meet founders - please get in touch using the form below

256Oracle is an algorithmically powered digital asset hedge fund

We trade across all cryptocurrencies, based on our technical and fundamental analysis

Fill out the form below and one of our fund managers will be in touch

We constantly review business ideas and meet founders - please get in touch using the form below

256Node is a decentralised asset exchange ( DEX ), which lists only asset backed tokens.

We trade across all cryptocurrencies, based on our technical and fundamental analysis

Fill out the form below and one of our fund managers will be in touch

We constantly review business ideas and meet founders - please get in touch using the form below

Contact 256 CONTACT

More detail questions ? Reach out to us and we’ll get back to you shortly.

- phone+44 0207 193 5796

- email hello@256.holdings

- teleJoin us on Telegram